Just as a “settlement” can describe a village where people have come to rest, so too does a “payment settlement” denote a monetary amount that’s reached its final destination. From the Old English word "setlan" meaning “to place in a seat”, settlement can be thought of as the final stage of a transaction.

When you submit a payment request, the message goes on a long journey. The first bold step is to enter through the payment gateway, and travel to the payment processor via the payment API. The message passes through the acquiring bank, the card scheme, and the issuer, who runs the transaction request through its own risk assessment service then delivers a response back.

After all that traveling – during which the payment request is authorized and authenticated – the payment (i.e. the movement of funds) can finally take place. Settlement is the moment that the requested fund amount is placed in the destination account. Therefore, an example of settlement is the transfer of funds from the issuing bank to the acquiring bank.

It’s a complex process, so here’s a visualization of the transaction request flow:

Settlement can only take place after all of the above stages are complete. Each stage is necessary for security and validation purposes; there are multiple reasons why a credit card transaction declines, and it’s important funds do not move from one account to another without authorization.

What are the different types of payment settlement?

The fact that payments involve multiple parties means there are a few different types of settlement. Reason being, each party has costs associated with processing a transaction and must charge fees accordingly. Deducting the amount owed while moving funds is a logical stage in the process to do so. It’s comparable to your friend eating two of your french fries as a “thank you” for collecting them from the counter and bringing them back to your table.

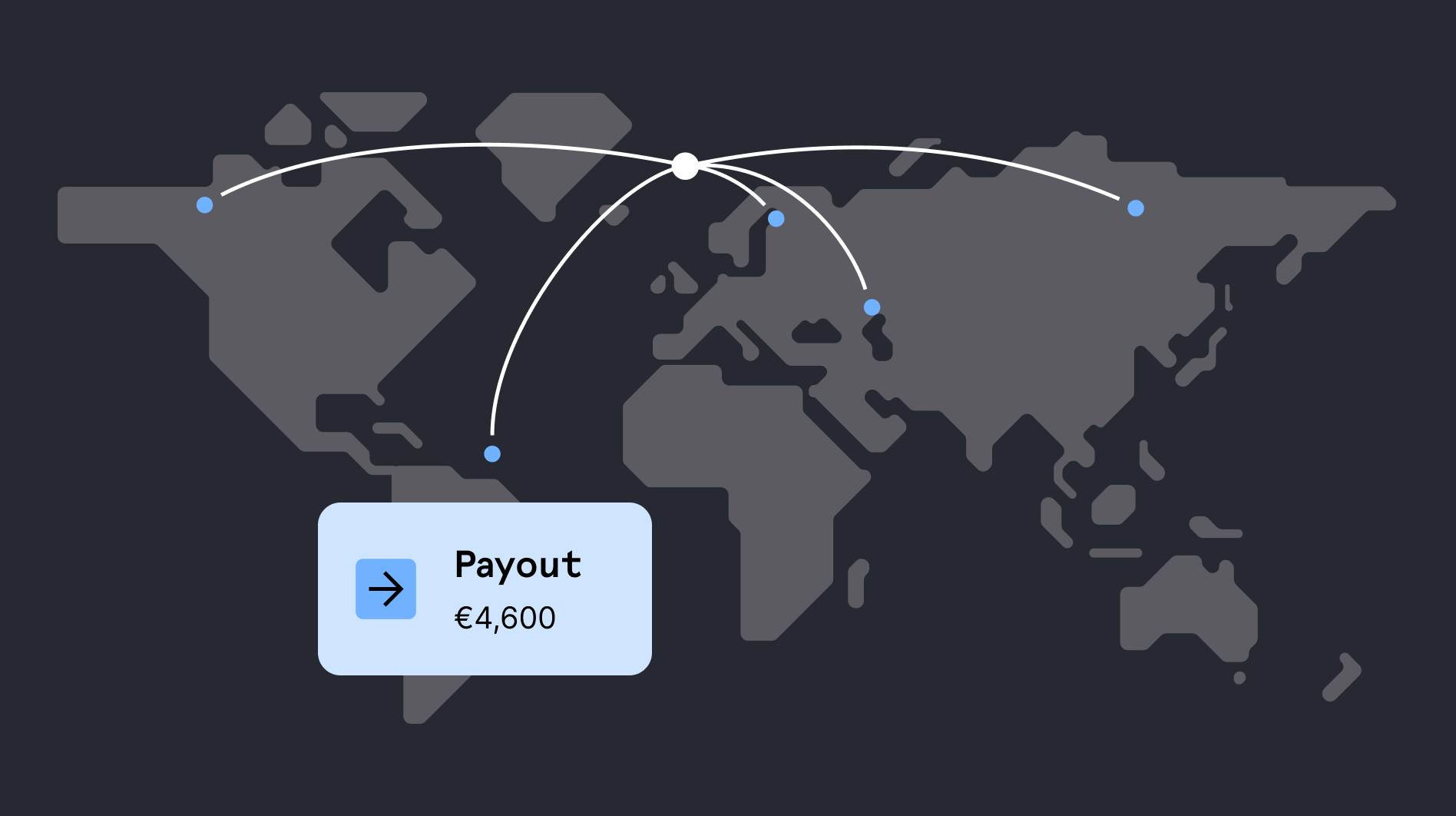

Issuer settlement: The issuer (i.e. the customer’s bank) transfers the transaction amount to the acquiring bank (i.e. the merchant account) via the relevant card network. This is a type of interbank settlement.

Merchant settlement: The acquirer (for example, Checkout.com) transfers the transaction amount to the merchant’s business bank account, minus fees. It’s also known as card acquiring settlement or client settlement.

Scheme settlement: In the context of acquiring, this is when the acquirer receives funds from issuers via the card schemes.

Difference between gross vs net settlement

Gross settlement: This refers to a settlement (funds transferred to a business bank account) that matches total sales, without fees deducted. The merchant will receive an invoice for the costs of payment processing.

Net settlement: This is a fund transfer from the acquirer to the merchant’s main bank account, less the payment processing fees. This is an easier setup to reconcile as fees are incurred and paid for as they arise

When does payment settlement take place?

Merchant settlement encompasses two separate processes:

1. Funds availability: when the acquirer (e.g. Checkout.com) makes the funds available on the merchant's account within their system. This happens in real time.

2. Merchant or external settlement: when the acquirer actually transfers the funds to the merchant's business bank account. This is almost always in batch.

Therefore, when a customer makes a purchase, the first phase of merchant settlement is real-time. The second stage is delayed until a batch payment is processed.

What happens is transactions are submitted to card schemes in batches (grouped together). At Checkout.com, we settle clients' bank accounts in batches (net) at the beginning of the following business day for the trading day just lapsed.

Newer networks such as FedNow (built by the Federal Reserve) offer faster access to sales funds by facilitating instant payments. International equivalents include Pix instant payments, managed by the Brazilian Central Bank and the Faster Payments Service (FPS) in the UK. The equivalent service in Europe is SEPA Instant Credit Transfer, known as SCT Inst.

How does payment settlement work?

In order to understand settlement, you need to see its place in the transaction life cycle. See below for a simplified summary of the card payment process, to provide the context for payment settlement.

- Authorization: When the acquiring bank receives a payment request from a merchant, it will contact the card scheme to initiate authorization. This is an electronic request to verify that the customer’s account exists and that it contains enough funds. When the payment is authorized, this means the scheme confirms the customer’s account is valid for making this payment.

- Capture: Next, the acquirer requests the funds be transferred from the issuing bank. The funds are “captured”, meaning the transaction amount is ringfenced ready for transfer. Funds are not actually moved at this stage, rather, the amount is placed on hold for use in this transaction (and cannot be used for another purpose).

- Settlement: There are several settlement processes which take place in transaction processing. Interbank settlement refers to the movement of funds from the issuing bank to the acquiring bank. This is a separate process from merchant settlement, which refers to the acquirer transferring funds to the merchant’s main business bank account.

As you can see from the above, settlement is the electronic transfer of funds to a destination account. This is why it’s often seen as the “final” stage in a transaction. It’s the moment when the acquirer credits the merchant’s business bank account with the funds from its sales.

Settlement is not the only option for fund management

It’s worth noting that funds can be used in different ways while still in the merchant account (before being settled to the business bank account). Merchants may wish to consider treasury solutions to make best use of captured funds, and avoid the delay of the acquiring settlement process. A common mechanism is Account Funding Transactions (AFTs), such as loading funds onto a business debit card.

Let’s look at an example of this, from an issuing perspective. One form of AFT is to use revenue from sales to fund custom payment cards with your own spending controls and security measures. It’s a more efficient way to manage cash flow and pay suppliers earlier than using funds from acquiring settlement.

Checkout.com handles payment processing end-to-end

As Checkout.com acts as both acquirer and processor, we can provide the granular data of payment performance from every transaction.

Our Dashboard gives you access to actionable data and insights you can use to optimize your payments experience, improve acceptance rates, and grow your revenue.

%20thumbnail.png)

%20(3).png)