Products used

Froda is one of Sweden’s fastest-growing fintech companies. With a mission to eliminate the complexities and costs that hinder the growth of millions of small businesses, Froda is transforming the financing experience. By digitizing this experience, they save entrepreneurs time, money, and energy, offering financing at the most competitive rates on the market.

In our conversation with Olle Lundin, Co-Founder and CEO at Froda, and Stella Snickare, VP Froda Embedded, we delve into Froda’s innovative products culminating from their partnership with Checkout.com.

With a unique career path that started in law, Olle transitioned into entrepreneurship, founding companies that have made a real impact. His journey includes founding a digital consulting company with a substantial workforce across the Nordics and the Netherlands.

Stella joined Froda two years ago and has since been at the forefront of developing embedded products. Her expertise in payments and passion for the field made her an integral part of the collaboration with Checkout.com, leading to the development of groundbreaking products.

Elodie: What inspired the founding of Froda, and what is Froda's primary offering?

Olle: When we founded Froda in 2015, our initial concept was embedded lending with a product called “Merchant Cash Advance”. However, the market wasn't ready, and building the necessary infrastructure took time. So, we pivoted to creating a direct lending business in Sweden, which we focused on for about five years. In 2021, we felt ready to shift our focus back to embedded lending, leading us to collaborate with partners like Checkout.com.

Our mission at Froda is to make funding accessible to SMEs at the best possible terms. We are agnostic about whether we do this through our direct or embedded lending platforms. The inspiration behind Froda came in 2015 during the European immigration crisis, where we saw the need to help refugees and SMEs.

SMEs are the backbone of the European job market, and they lacked access to capital.

Traditional banks weren't addressing this need due to a focus on profitability. We decided to build a bank solely focused on SMEs, which allows us to serve SMEs effectively. Now, we are in a strong position to make a meaningful impact on SMEs through our direct lending business and embedded platform. We're rapidly growing with about 100 employees and a clear path forward.

Elodie: With your focus on growth and scaling, what were Froda's main challenges entering the market?

Olle: We faced numerous challenges, but we've made significant strides in overcoming them. One major hurdle was securing the necessary funding, a challenge SMEs grapple with. To address this, we made the strategic decision to become a bank, enabling us to access affordable funding by taking deposits from the general public, guaranteed by the state. This provided us with cost-effective funding across various markets.

Another obstacle was the development of a highly scalable and automated product. Achieving this scale profitably required the creation of credit models based on machine learning, which, in turn, necessitated the accumulation of substantial data. Building this data from scratch was time-consuming, but our long-term focus justified the investment of five years to amass the required data and obtain a credit institute license.

These are just a few examples of the challenges we've faced, some of which were technical in nature. Nonetheless, we've successfully built a revenue-generating and profitable business.

Driving customer satisfaction by catering to the needs within the credit industry

Elodie: What are the changing needs and challenges in consumer habits and the SME sector?

Olle: Understanding our customers' needs is fundamental to us. We observed how traditional banks operated with manual, time-consuming processes, requiring SMEs to produce extensive materials and collateral. SMEs don't want to spend their core business time dealing with banks and paperwork.

For the customer interface, it makes sense for SMEs to access finance where they already spend their time. Whether that's through a partner's mobile app in the payment industry or on an incumbent bank's website, we aim to be present where our customers are. We've developed an embedded product that allows us to project our services where the customers already are. It's about utilizing existing ecosystems, making it as convenient as possible for the SMEs.

The importance of payment integration across Europe's diverse landscape

Elodie: Could you shed some light on payment integration's role in Froda's operations and offerings?

Stella: Payment integration is a pivotal part of our customer journey at Froda. It encompasses both loan payouts and repayments, including loan and interest repayments. We embarked on this journey when considering expanding our embedded lending product beyond the Nordics. The payment infrastructure was one of the most complex challenges we encountered in each new market.

For instance, in Finland, Direct Debits aren't the preferred method. They prefer electronic invoices. Meanwhile, Norway has its own set of preferences. Customer behavior varies across different countries, and even though certain payment methods like Direct Debits may seem universal, SMEs and consumers in various European countries are unaccustomed to them.

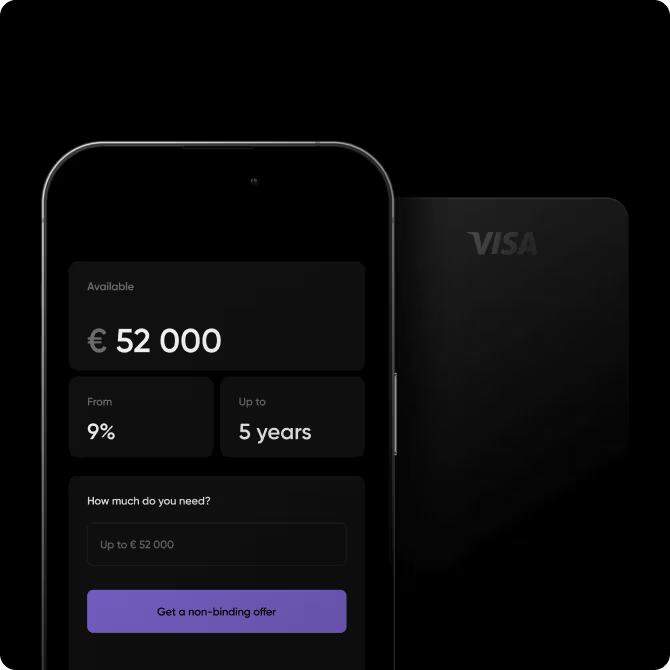

We aimed to create a product that could resolve the payment infrastructure challenges across all European countries and, potentially, on a global scale as we expand. In our view, few payment methods offer geographical coverage, familiarity to users, and easy integration into digital onboarding processes that card-based payments do. This drove us to consider card-based embedded lending.

“We recently announced our integration with Visa Direct, enabling instant push payments for loan payouts. Combining this with our automatic credit assessments, completing a loan application takes just 2 to 3 minutes. Within seconds, the loan is paid out to their account. This sets us apart from competitors and incumbent banks, which typically take at least eight weeks.”

Stella

We've integrated card enrollments directly into the loan application, making it convenient for customers. Our solution covers all financial transactions related to managing an SME loan, and it streamlines the process significantly. We recently announced our integration with Visa Direct, enabling instant push payments for loan payouts. Combining this with our automatic credit assessments, it takes just 2-3 minutes to complete a loan application. Within seconds, the loan is paid out to their account. This sets us apart from competitors and even incumbent banks, which typically take at least eight weeks.

Efficient payments as the cornerstone of a positive digital experience and growth

Elodie: You've turned to Checkout.com and Visa to provide solutions for efficient payments. Please share what led you to choose to work with us.

Stella: When I first started sketching out the idea for this product, it was just a flowchart of how the financial process would work and how we could share tokens between entities. At that point, I wasn't entirely sure how to execute it. So, I began speaking with different acquirers, showing them this early concept and expressing my idea to figure it out together.

A former colleague I discussed this concept with strongly recommended talking to Checkout.com. So, I booked a meeting and shared my PowerPoint.

This was the key reason why we decided to collaborate.

Creating innovations between Froda, Checkout.com, Visa, and Lunar

Elodie: How has the collaboration among the four entities been working? Can you share some insights into the process?

Stella: Lunar played a significant role for Froda. As a Nordic Neo Bank, they have a strong market presence, particularly in Denmark. They've expanded to Norway and Sweden as well. We collaborated with Lunar to launch our card-based lending product. Lunar was the first partner to utilize it, and we had many conversations with Checkout.com to figure out how it should work.

The collaboration worked well because we were all eager to solve the same problems. We leveraged new technology, such as tokens, to enhance the customer experience. We aimed to eliminate the need for customers to manually enter card details, retrieving the information from the bank instead. We also introduced a fresh use case for Visa Direct's push payment product.

All parties wanted an embedded lending product that could be launched uniformly across Nordic markets, with the same onboarding flow for repayments and payouts. They were interested in the card-based solution and eager to explore new applications of their technology.

“We felt Checkout.com was motivated to create something innovative and leverage its existing infrastructure for a new use case. The collaboration was a real success because all involved entities were aligned with their strategic priorities for this project. It's been an amazing experience overall.”

Stella

Elodie: Looking ahead, what does success look like for Froda in the next twelve months, and how do you envision Checkout.com's role in achieving that success?

Stella: Our aim for the coming year is to expand into two more European countries. Currently, we operate in all the Nordic nations and the UK, but the goal is to be present in at least eight European countries. We also intend to refine our product and establish new partnerships. Particularly noteworthy is our interest in the incumbent bank sector. Froda's inception was driven by the observation that incumbent banks didn't adequately serve SMEs, and now we're witnessing a growing interest among these banks in addressing SME needs.

.png)