It's never been more important for businesses operating in the digital economy to focus on mitigating the risk of online payment fraud. But, to achieve this effectively, these businesses need access to data that empower them to uncover patterns of malicious behavior and stop fraud in its tracks.

Here we provide an introduction to fraud analytics, highlighting:

- What is fraud analytics?

- Why is fraud analytics important?

- Data analysis techniques for fraud detection

- How machine learning and artificial intelligence aid fraud detection

- The benefits of leveraging fraud analytics

- How Checkout.com gives merchants access to a wealth of fraud analytics

What is fraud analytics?

Fraud analytics uses data analytics to help organizations detect and prevent online fraud. Fraud analytics entails collecting, storing, and analyzing relevant data to find patterns and anomalies that may signal suspicious or risky behaviors, then turning those discoveries into insights that merchants can use to help manage fraud.

Online businesses must apply fraud detection analytics to combat bad actors because employees cannot manually analyze the massive number of transactions that flow through their systems daily. Fraud analytics enables merchants to identify fraud patterns in order to create new interventions to block future fraudulent attacks.

Why is fraud analytics important?

Fraud analytics are essential to any effective fraud prevention strategy. Every business experiences fraud in different ways, so you can’t base your defense measures on assumptions or general trends.

According to Checkout.com's State of Retail report, 25% of ecommerce companies worldwide are experiencing a significant increase in card-not-present (CNP) fraud and chargebacks. And, as economic conditions tighten, that number is likely to grow.

Additionally, the total cost of ecommerce fraud to merchants will surpass $48 billion in 2023, up from slightly more than $41 billion in 2021, according to a study from Juniper Research. Fuelling this growth, according to Juniper, will be "the increased use of alternative payment methods, such as digital wallets and BNPL (buy-now-pay-later), which are creating new fraud risks."

A constant analysis of your own datasets allows you to identify the specific threats faced by your business, and to uncover the limitations in your prevention strategy. Without analytics to impose some order, the sheer volume of data generated daily by customer behavior, transactions, and other activities would be impossible to derive useful insights from via manual review.

What’s more, the fraud threat faced by online businesses has never been greater. New technologies are evolving in tandem with new ways to exploit them. Automated fraud prevention solutions can analyze data from across entire networks to help you stay on top of the latest fraudulent trends so that you can develop suitable defense measures.

The upshot of all of this, of course, is that fraud analytics protects you from the financial losses of a successful attack, helps to maintain your reputation, and builds trust with your customers.

Learn more: The regions with the highest credit card fraud

Data analysis techniques for fraud detection

As sophisticated as modern fraud detection solutions are, they still require some human input and understanding in order to generate meaningful insights.

When used in conjunction with each other, the following techniques can help you to develop a holistic picture of the various risks and fraud threats you face and to build a tailored and effective prevention strategy.

Predictive fraud analytics

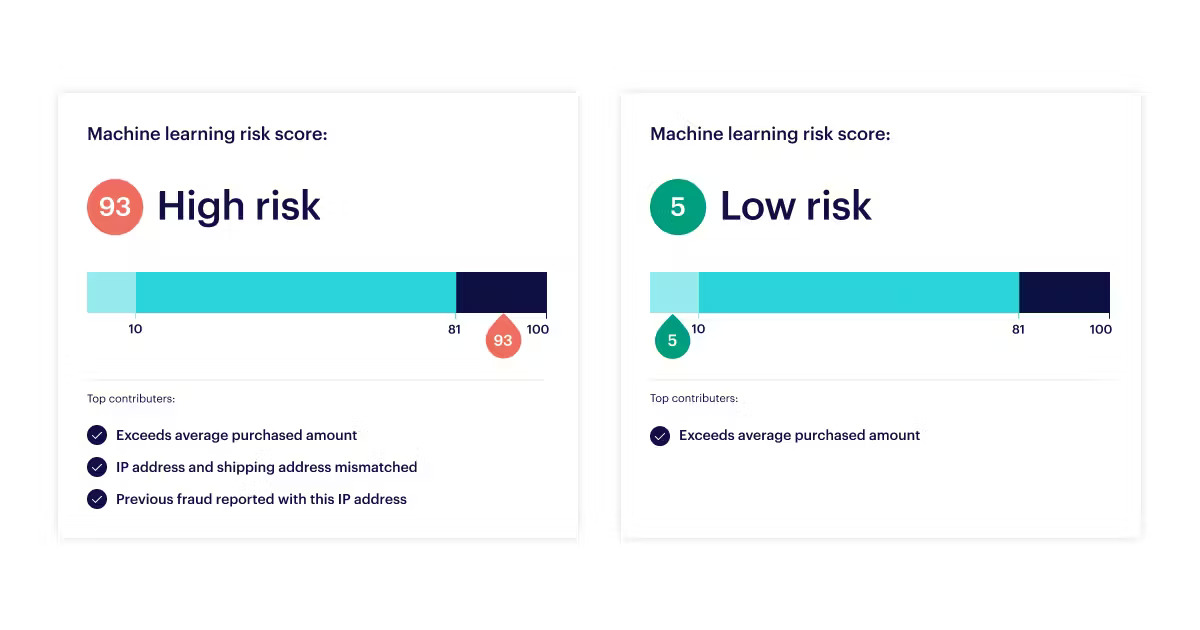

Predictive fraud analytics uses historical data to predict future outcomes. For example, you can develop risk scores for transactions based on past data and then automate actions for any future transactions that surpass an acceptable risk threshold. This allows you to be super responsive to suspicious activity.

Here’s how to implement predictive analytics:

- Label all historical transaction data as either fraudulent or not. This will help to train your machine learning model to spot future transactions with similar characteristics

- Disregard variables that are too evenly distributed to be useful indicators of suspicious activity - they will only make it harder to identify genuinely fraudulent behavior

- Now your system has been trained on useful indicators, it can flag unusual activity and you can create targeted rules for specific risks

- These rules can automatically route suspicious transactions for further authentication or to be blocked

Learn more: Fraud rules engines

Descriptive analytics

Descriptive analytics can automatically uncover statistical outliers in your data that could indicate fraudulent behavior. Based on historical data, descriptive analytics looks for anything that deviates significantly from a mean or expected data point or score, whether that’s a sudden increase in transaction volume from a particular customer or a sudden change in the location of their transactions.

Descriptive analytics is a relatively simple form of data analysis, as it identifies trends and anomalies but doesn’t dig deeper. However, that makes it a very accessible form of analytics that can inform rapid decision-making.

Pattern recognition

Pattern recognition is at the foundation of all fraud detection. Your machine learning algorithm constantly analyzes large volumes of data to discover typical patterns (normal behavior) and those that deviate from the norm (unexpected behavior), which could be a sign of fraud.

Visual analytics

Visual analytics helps you to analyze datasets by representing them in graphs, charts, maps, and other useful visual formats. This is especially useful when trying to derive actionable insights from massive datasets or when combining data from multiple sources. As a more democratic and accessible way to present data, it also makes it easy to share findings across your organization and to get more people involved in decision-making.

Rule-based analytics

Rule-based analytics uses predetermined rules to draw conclusions from datasets and instigate predefined outcomes. This cause-and-effect methodology is useful for analyzing basic data and automating straightforward, repetitive actions. However, in contrast to machine learning, which learns to define its own rules and adapt as it processes new information, rule-based analytics is not as scalable and responsive.

Big data analytics

Big data analytics is the analysis of massive and diverse datasets to uncover useful insights through data mining, machine learning algorithms, and anomaly detection. It’s a highly effective way of making sense of the masses of data points generated by transactions and customer behavior that would be impossible using manual processes. For growing businesses, big data analytics is essential for detecting and preventing fraud at scale.

Artificial intelligence and machine learning in fraud detection

As online fraud becomes ever more present, it's also becoming more sophisticated. And as fraudsters use new technologies and tactics, businesses must do all they can to stay one step ahead of these threat actors.

That means accessing and analyzing data—and lots of it. That's where fraud detection machine learning models come into play. They can work around the clock to analyze huge amounts of data in real-time.

Fraud detection uses machine learning to enable online retailers to quickly detect suspicious transaction activity as well as spot patterns of behavior before any fraud occurs. When it comes to fraud analysis, machine learning is a set of artificial intelligence (AI) algorithms that can analyze huge amounts of data and suggest risk rules based on patterns that they identify.

Merchants can then deploy the rules to allow or block specific activity, such as fraudulent transactions, suspicious logins, and identity theft.

Since it's easier for machines to process large amounts of data than it is for humans, the system can more quickly identify suspicious behaviors and patterns that would likely take employees months to detect.

In addition, machines take much less time to analyze all the transaction data that continually flows into merchants' systems. And machine learning is better able than humans to assess customer behavior in real-time, analyzing typical activities and blocking or flagging anomalies for review.

Gathering and processing data from user activity and payment transactions gives merchants better insight into fraud attempts. And machine learning and artificial intelligence enable these online retailers to take corrective actions when threats are detected.

The benefits of using fraud analytics

Online businesses that implement fraud detection analytics can expect to realize several benefits, including:

Time savings

Fraud prevention services that employ machine learning and artificial intelligence enable online retailers to save hundreds of hours of research that their employees would have to do manually during a fraud investigation.

More sales with good users

Using the data gathered by a fraud detection system can help merchants better understand their customers, including how often they shop, the average value of the items in their shopping carts, and what types of items they purchase. That means online retailers can send promotions to regular customers, encouraging them to spend more than they usually would by offering higher-value items they may be interested in. With a fraud detection solution, merchants can accurately make these decisions. Additionally, the risk that these good orders will be flagged as fraudulent is low.

Boost authorization rates

An authorization rate is the percentage of transactions online retailers submit that are reviewed and approved by the cardholder's bank. Issuing banks are not too keen on merchants that process a high number of unauthorized transactions. Consequently, the issuing banks will consider those merchants high risk and decline their authorization requests when they're submitted. However, online businesses that deploy proper risk management and control fraud can boost their authorization rates and earn more revenue.

Enhance customer satisfaction

Fraud can quickly damage merchants' relationships with their customers, causing those customers to lose trust in them. For example, if a bad actor compromises customer accounts and makes off with their loyalty points, those customers will likely blame the merchants for not adequately securing their accounts. In addition, those customers might decide not to purchase from those businesses again. However, companies implementing fraud detection and prevention solutions can stop cyber criminals from breaching their systems and compromising customer accounts, ensuring a better customer experience.

Preventing chargebacks

Fraud analytics can help merchants prevent costly chargebacks. Chargebacks occur when legitimate customers contact their card issuers to refund their purchases, saying they don't recognize the charges or didn't make them. This may happen because fraudsters stole their card details and made unauthorized charges.

In many cases, though, those legitimate customers did make the purchases and are trying to scam the merchants—this is sometimes called friendly fraud (or chargeback fraud). Chargebacks allow those customers to keep their purchases without paying for them, meaning merchants lose out on the revenue from those purchases and may even experience lower authorization rates and have to enroll in a monitoring program. But fraudulent or not, chargebacks hurt merchants' bottom lines.

By preventing fraud, online retailers can stop the resulting chargebacks, friendly or otherwise. Fraud analytics can detect anomalies in transactions that could indicate that fraudsters are trying to make unauthorized transactions. Analytics also help online businesses determine if their legitimate customers are trying to engage in friendly fraud. That's because fraud analytics can detect anomalies in customers' orders that might suggest a risk of friendly fraud—for example, if customers' order amounts are larger than usual or if customers are making more frequent purchases.

Read more: How to prevent chargebacks

Prevents money laundering

Preventing money laundering isn’t just a matter of stopping criminals from disguising their ill-gotten gains; it’s essential to ensure your business is complying with anti-money laundering (AML) regulations.

One major aspect of AML requirements that fraud analytics can help with is transaction monitoring. In order to identify and prevent fraud, you’re required to monitor and record all customer transactions and review any that indicate suspicious activity or pass value thresholds determined by your regulator.

Using rules, machine learning, and the analytical techniques described above, you can automate actions for any suspicious transactions, making it easy to comply with AML regulations.

How Checkout.com helps businesses with fraud analytics

Checkout.com's Fraud Detection Pro's machine learning engine studies billions of transactions, enabling merchants to benefit from Checkout.com's global network alongside a set of sophisticated risk tools to block fraud and identify legitimate customers. In 2022, Checkout.com's fraud detection solution saved merchants over $1.95 billion in potential losses due to fraud.

Checkout.com's Fraud Detection Pro is a state-of-the-art fraud detection solution that uses machine learning and advanced rules to monitor transactions for suspicious activity. As such, the more online retailers use the solution, the better it will identify fraud.

With Fraud Detection Pro, Checkout.com gives merchants the necessary features to combat fraud effectively, improve their authorization rates, and make it easier for legitimate customers to do business with them.

Predictive analytics for fraud detection

Checkout.com's Fraud Detection Pro uses advanced machine learning to detect new fraudulent trends based on data analysis across the entire Checkout.com network. The tool's machine learning feature is trained on billions of hard and soft data points from Checkout.com’s global network of merchants. And it also learns from patterns of real fraud across multiple industries and countries, applying these insights to detect and stop suspicious activity at the points of the transactions. Merchants would otherwise be more exposed to fraud because they don't have broader insights and historical data about existing and emerging fraud patterns.

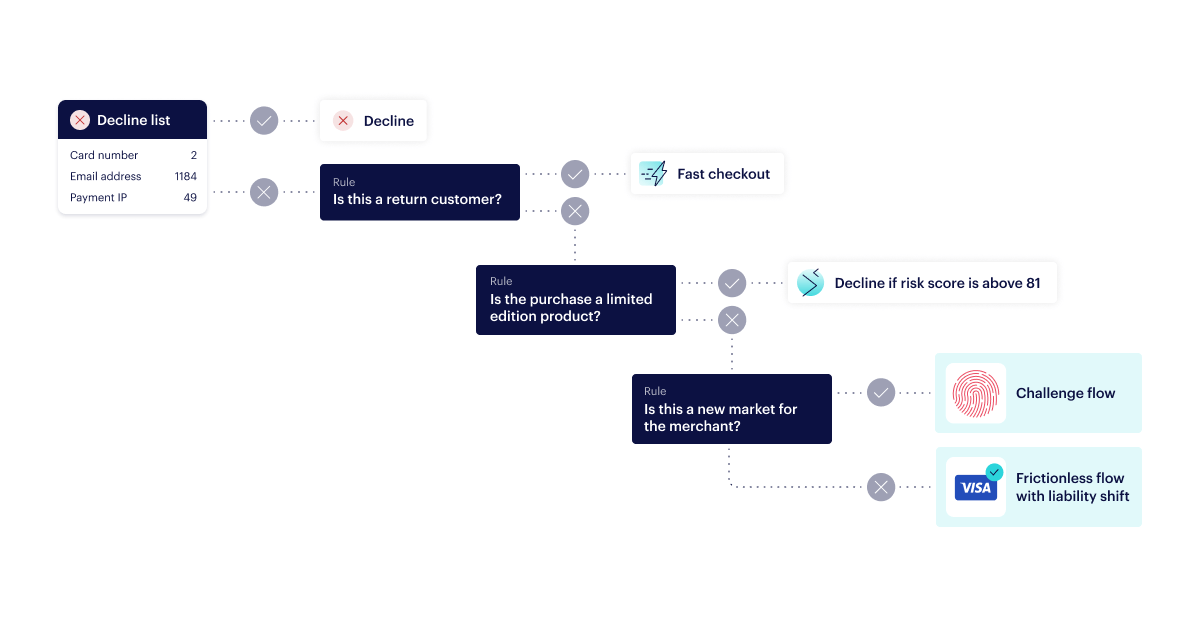

Set and customize rules

Using Checkout.com's data and specific rules, Fraud Detection Pro is fully customizable. It can easily adjust to new threats, so merchants have one less thing to worry about. Checkout.com's solutions allow merchants to completely control their customer journeys to deploy either rules-based or dynamic machine-learning authentication strategies.

Fraud analytics risk dashboard

Fraud Detection Pro’s analytics dashboard offers merchants a single source for monitoring and analyzing all their payments. The key performance indicators, payment history, details, and analytics are all in one place.

The dashboard helps merchants monitor the effectiveness of their risk strategies and identify areas they can optimize to operate more efficiently. These include:

- Total fraud - this refers to the sum of fraudulent transactions found in your business operations

- Fraud rate split by card scheme - the proportion of fraudulent transactions for each specific card scheme can be a useful metric to detect vulnerabilities e.g. from Visa and Mastercard).

- Declines - monitoring both types of pre-authentication and post-authentication declines helps you see where potential fraud might be occurring in the transaction process

- Authorizations - checking authorizations can help you identify fraud attempts that are unusual or suspicious

- Payment lifecycle overview - using a sanky diagram can provide a clear picture of how payments move from initiation to completion and help you pinpoint where potential vulnerabilities exist

- Granular fraud report - reports that are customizable by date range allows you to understand the specifics of each fraudulent event, and patterns to help you improve your fraud prevention strategies

- Decline rule performance - this can show you the impact of each rule that can decline a transaction, including trendlines to understand how often each rule is triggered on different days

- Risk assessment timeline at a payment level - viewing this data on a dashboard is helpful to understand the machine learning (ML) score breakdown and detail on the contributing factors that led to that score.

Learn more about Fraud Detection Pro or get in touch with us to find out more about how it can help your business.

.png)

.png)